Pendle Finance (1)

Based on the provided FAQ from Pendle Finance's website, I'll summarize and highlight key aspects that are critical for understanding the platform, its unique offerings, and associated risks.

Pendle Finance Summary

Based on the provided FAQ from Pendle Finance's website, I'll summarize and highlight key aspects that are critical for understanding the platform, its unique offerings, and associated risks. This summary will serve as a concise guide to Pendle Finance, focusing on its innovative approach to managing yield-bearing assets through Yield Tokens (YT), Principal Tokens (PT), and the role of Liquidity Providers (LP), alongside the concept of Liquidity Reward Tokens (LRT) and points system

Core Concepts: YT, PT, and LP

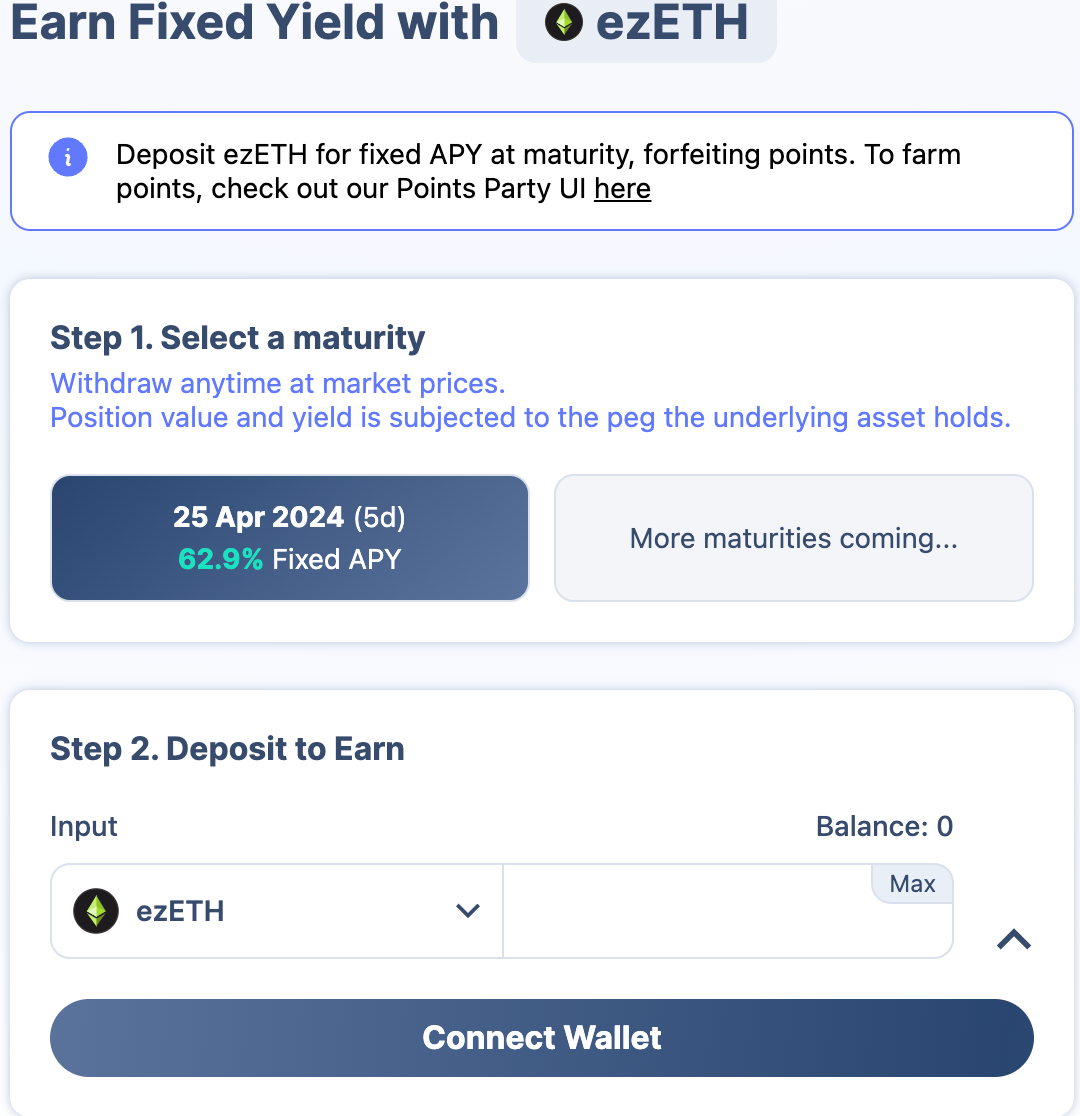

- Yield Token (YT) and Principal Token (PT): Pendle separates yield-bearing assets (e.g., eETH, stETH, GLP) into two distinct components - YT, representing the future yield, and PT, representing the principal. This separation allows for unique trading strategies and risk management possibilities.

- Liquidity Providers (LPs): Facilitate the trading of YT and PT on Pendle's platform, contributing to market liquidity and earning rewards in the process.

Key Features

- Swap between PT and YT: Users can freely swap between PT and YT, offering flexibility in managing yield and principal exposure.

- Negative Long-Yield APY for YT: This occurs when the cost of YT exceeds the expected yield. However, YTs receive points which might offset this negative APY, though Pendle assumes these points have zero value for conservative estimation.

- No Obligation to Hold Until Maturity: Users can exit their positions in YT or PT before maturity, though this may involve certain risks.

- Redemption: At maturity, 1 PT-weETH redeems for 1 eETH in its yield-bearing form, regardless of the exchange rate between weETH and eETH at that time.

Risks

- Smart Contract Risks: Common in DeFi protocols, involving vulnerabilities in the contract code.

- Market Risks for YT and PT: The value of YT and PT can fluctuate, affecting the cost and yield received. Exiting positions before maturity may expose users to price risks.

- LP Risks: Similar to YT and PT, LPs face price risks if exiting before maturity. However, there is no impermanent loss (IL) at maturity.

Points System

- Accrual and Tracking: Points accrue from deposits in LP tokens to platforms like Penpie and Equilibria and can be tracked on respective dashboards of underlying protocols (e.g., Ether.fi for eETH).

- Leveraged Points for YT: Pendle streams points from the underlying assets to YT holders, enhancing YT's value proposition without generating additional points.

- EigenLayer Points: Depositing LRTs on Pendle on Arbitrum also earns EigenLayer points, subject to the underlying protocol's policies.

Zero Price Impact LP (ZPI)

- ZPI Feature: Allows LPs to retain their YT exposure during liquidity provision, reducing the yield but preserving points exposure. Turning off ZPI results in full capital utilization but alters the points exposure.

- Adjusting Points Exposure: Users can adjust their points exposure by buying more YT equivalent to the PT in their LP position if they forgot to turn on ZPI.

Bridging and Caps

- Bridging LRTs to Arbitrum: Specific bridges are recommended for different assets (weETH, rsETH, ezETH) to ensure proper functionality and points accrual on Arbitrum.

- USDe / sUSDe Cap: A cap on these assets prevents new purchases of YT/PT/LP with external assets due to Ethena's risk guidelines, affecting liquidity and trading strategies.

Additional Notes

- No Staking Required: Holding YT, PT, or providing liquidity automatically entitles users to the respective assets' benefits without additional staking.

- Support and Community: Pendle encourages users to utilize its Discord for unanswered questions, emphasizing community support and engagement.

Conclusion

Pendle Finance presents an innovative approach to DeFi, allowing users to separate and manage yield and principal components of their investments. Through its YT, PT, and LP system, alongside a unique points system, Pendle offers flexibility and new strategies for yield management. However, users must be mindful of the associated risks, particularly regarding smart contract vulnerabilities and market fluctuations. The platform's support for bridging assets and its cap system further reflect its adaptability and responsiveness to the broader DeFi ecosystem's needs.